Optimism in the Air – Four Sectorial Opportunities as Market Trends Shift

Author – Brijesh Bhatia (@bbrijesh9)

Pune, 24 March 2025: The IPL 18 is in full swing, and much like the excitement of a thrilling cricket match, the stock market bulls have kicked off a new trend. Last week, the Nifty surged impressively by 4.26%, reaching a high of 23,402 from the low of 23,353. As the market enters a reversal phase, it’s important to monitor the sectors that are set to outperform closely. These sectors are the ones likely to gain more than their underperforming counterparts, offering opportunities for savvy traders to capitalise on emerging trends.

Understanding how to analyse these sectors is just as critical as recognising the market’s momentum. This is where the Definedge Momentum and Performance (DeMAP) method comes into play—an insightful tool for identifying which sectors and stocks are positioned to take advantage of the market’s new direction.

Let’s explore DeMAP and how it can help us select the right sectors to watch during the current market reversal.

Understanding DeMAP

DeMAP (Definedge Market Analysis and Performance) is a comprehensive analytical framework used to track market trends and assess the performance of various stocks and sectors. It integrates multiple price action forms, momentum indicators, trend-following tools, and oscillators. The DeMAP methodology draws upon the best practices in technical analysis, including:

- Price Analysis

- Momentum Indicators

- Trend-Following Indicators

- Range-Bound Oscillators

- Relative Strength and Dynamic Relative Strength Analysis

- Candlestick Chart Patterns

- Point & Figure, Renko, and Line-Break Charts

- Price Patterns on Multiple Charting Methods

Combining all these techniques, DeMAP offers a multidimensional market view, enabling traders to make well-informed decisions. The results of these calculations are presented in a unique format, dividing stocks into two broad categories: Sky and Water.

- Sky: Stocks above the zero line in DeMAP, indicating a bullish outlook.

- Water: Stocks below the zero line, suggesting a bearish outlook.

With DeMAP, let us analyse the key sectors to watch in the current market reversal.

Sectors to Focus on in the Current Market Reversal

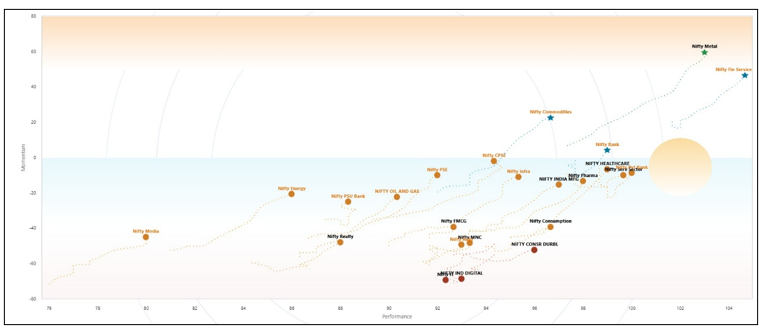

As the market embarks on its reversal phase, it’s crucial to pinpoint sectors that have the potential to outperform. Based on the latest DeMAP analysis, here are four key sectors that are poised for attention:

Source: RZone

- Nifty Metals

Source: TradePoint

- Nifty Financial Services

Financial services have always been a critical sector during market reversals. The Nifty Financial Services index includes banks, non-banking financial companies (NBFCs), and insurance companies — all of which benefit from a bullish market environment.

Source: TradePoint

- Nifty Commodities

The Nifty Commodities sector is another promising area to focus on. Commodities, including energy, agriculture, and raw materials, tend to experience strong price movements during market reversals due to their sensitivity to supply and demand dynamics.

Source: TradePoint

- Nifty Bank

The Nifty Bank index, which comprises the major banking stocks, is always a critical sector to watch. With its large market capitalisation and essential role in economic activities, the banking sector is one of the first to react to a market reversal.

Source: TradePoint

The Optimism in the Market Reversal

As evidenced by the 4.26% rally in the Nifty last week, the current market reversal phase presents an optimistic outlook for traders and investors alike. By focusing on the outperforming sectors identified by DeMAP, such as Nifty Metals, Nifty Financial Services, Nifty Commodities, and Nifty Bank, there are ample opportunities to capitalise on the market’s positive trend.

In times of market volatility, embracing a proactive and well-researched approach can make all the difference. With DeMAP as your guide, you can make confident, data-driven decisions and optimise your strategy as the market continues its reversal. As the market bulls charge forward, now is the time to be optimistic and prepared for future opportunities.

Disclaimer: The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. This article is strictly for educative purposes only.

As per SEBI guidelines, the writer and his dependents may or may not hold the stocks/commodities/cryptos/any other assets discussed here. However, clients of Definedge may or may not own these securities.

About Writer:

Brijesh Bhatia has over 18 years of experience as a trader and technical analyst in India’s financial markets. He is a well-known face in the business channel as a Market Expert and has worked with broking giants like UTI, Asit C Mehta, and Edelweiss Securities. He is currently a Senior Research Analyst and Editor at Definedge.