Nifty Infrastructure Index Marks First Bullish Reversal in Months

Author – Brijesh Bhatia (@bbrijesh9)

Pune, 01 April 2025: March 2025 witnessed a promising shift in the stock market, as the bulls brought an end to the Nifty50’s five-month losing streak with a remarkable 6.3% gain. This positive momentum was driven by a series of short-covering rallies in several sectors, while others saw long buildups. Among the sectors that stood out with a significant trend reversal, the Nifty Infrastructure index emerged as a key player, marking its first bullish signal since September 2024.

Let us dive deeper into the recent trend of the Nifty Infrastructure Index and what its chart reveals for future prospects.

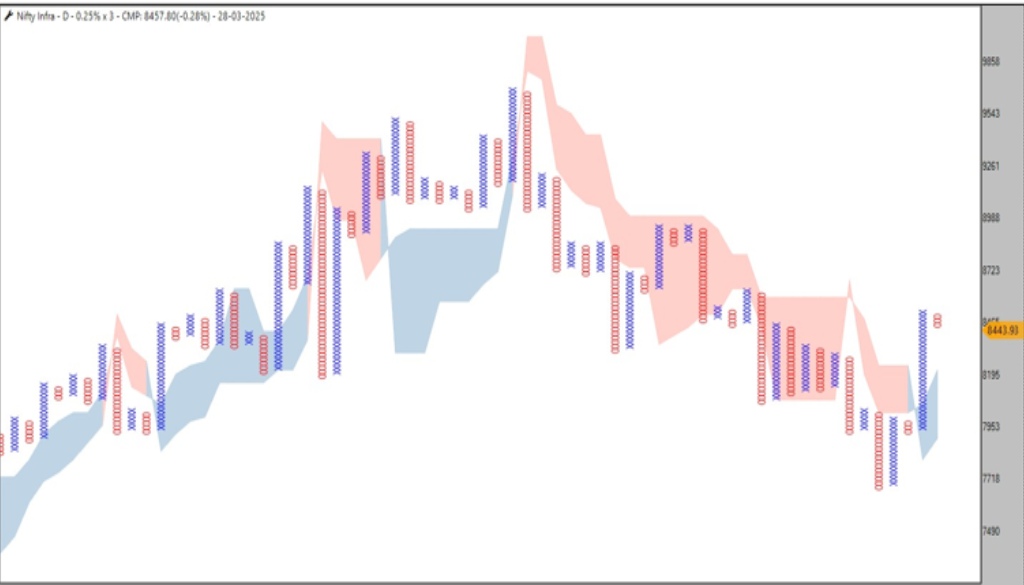

Nifty Infrastructure P&F Chart

Source: TradePoint, Definedge Securities

On the Daily 0.25% X 3 Point & Figure (P&F) chart, the Nifty Infrastructure index has witnessed a remarkable reversal, aligning with the broader market’s bullish outlook. The reversal was confirmed by the formation of a Bullish Anchor Column pattern.

Since September 2024, the index has been trending in a bearish phase, slipping below the D-Smart line. However, the significant reversal in March 2025 saw the index break above this line, signalling a potential bullish trend. More excitingly, the chart indicates a breakout at the 8,525 level, which could potentially trigger the continuation of this upward momentum. The formation of the Anchor Column Follow Through (AFT) pattern is another strong signal that the bulls are gaining control.

Given this technical setup, the Nifty Infrastructure index is poised to continue its upward trajectory, and investors are keenly watching for a break above the critical 8,525 level.

Trending Bullish Stocks in the Nifty Infrastructure Index

As the Nifty Infrastructure index turns bullish, certain stocks are standing out with promising trends. Two such stocks are Indigo and Shree Cements, both of which are showing potential for further gains.

- Indigo: A High-Flyer in the Infrastructure Space

Indigo, India’s leading low-cost airline, is making waves in the Nifty Infrastructure index with a strong bullish outlook. The daily chart of Indigo shows a breakout above its previous high, a key indicator of strength. Following the breakout, the stock retested the Rs. 5,000 level, and the AFT pattern suggests that the bulls are firmly in control of the trend.

Source: TradePoint, Definedge Securities

Investors should note that the breakout may be negated if the stock falls below Rs. 4,900. However, as long as the stock stays above this level, the bullish potential remains intact, making it a strong candidate for those looking to benefit from the ongoing infrastructure boom.

- Shree Cements: Hitting New Highs with Strength

Shree Cements, a key player in the Indian cement industry, has been in the spotlight as it trades at an all-time high, signalling a robust bullish trend on the P&F chart. The stock has broken through multiple levels of resistance, reinforcing the strength of the ongoing uptrend.

Source: TradePoint, Definedge Securities

Traders and investors should consider any pullbacks as potential buying opportunities, as the long-term outlook for Shree Cements appears strong. With the infrastructure sector’s growth trajectory, Shree Cements is well-positioned to capitalize on the wave of expansion, making it an attractive investment choice for those looking to contribute to India’s future infrastructure development.

A Bright Future for Nifty Infrastructure

The Nifty Infrastructure index’s reversal in March is a breath of fresh air for market participants who have been watching the broader market’s volatility. With bullish patterns on the charts and strong individual stocks, such as Indigo and Shree Cements, leading the way, the outlook for the infrastructure sector is potentially bright.

Disclaimer: The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. This article is strictly for educative purposes only.

As per SEBI guidelines, the writer and his dependents may or may not hold the stocks/commodities/cryptos/any other assets discussed here. However, clients of Definedge may or may not own these securities.

About Writer:

Brijesh Bhatia has over 18 years of experience as a trader and technical analyst in India’s financial markets. He is a well-known face in the business channel as a Market Expert and has worked with broking giants like UTI, Asit C Mehta, and Edelweiss Securities. He is currently a Senior Research Analyst and Editor at Definedge.