Mutual Fund Activity in February 2025: What Fund Houses Bought and Sold

Pune, 15 March 2025: With the market experiencing a downturn, the total Assets under Management (AUM) of the mutual fund industry has declined to ₹64.5 lakh crore from ₹67.3 lakh crore in January 2025. Despite this, net inflows into the industry remained strong at ₹40,063 crore. However, Systematic Investment Plan (SIP) inflows dipped below ₹26,000 crore, marking a three-month low.

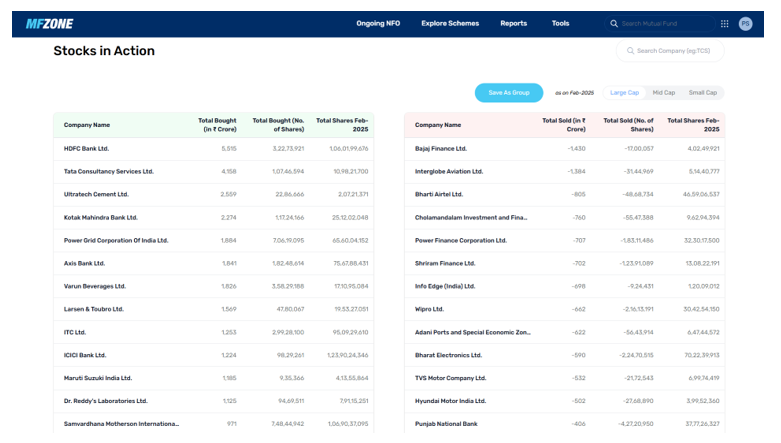

Large-Cap Stocks: Key Buy and Sell Moves

Mutual funds continued to accumulate select large-cap stocks, with significant investments in:

- HDFC Bank – ₹5,515 crore

- Tata Consultancy Services (TCS) – ₹4,158 crore

- UltraTech Cement – ₹2,559 crore

Meanwhile, some notable exits included:

- Bajaj Finance – ₹1,430 crore

- InterGlobe Aviation (IndiGo) – ₹1,384 crore

- Bharti Airtel – ₹805 crore

Source: MFZone By Definedge

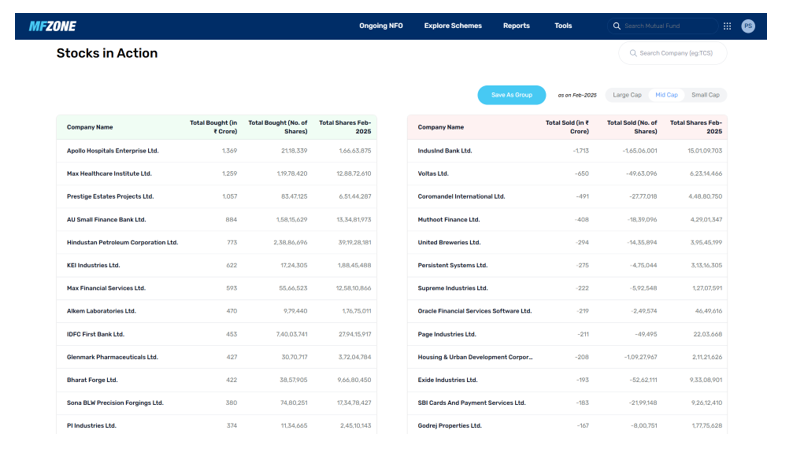

Mid-Cap Stocks: Shifting Allocations

In the mid-cap segment, fund houses added to their portfolios:

- Apollo Hospitals – ₹1,369 crore

- Max Healthcare – ₹1,259 crore

- Prestige Estates Projects Ltd – ₹1,057 crore

However, they cut positions in

- IndusInd Bank – ₹1,713 crore

- Voltas – ₹650 crore

- Coromandel International – ₹491 crore

Source: MFZone By Definedge

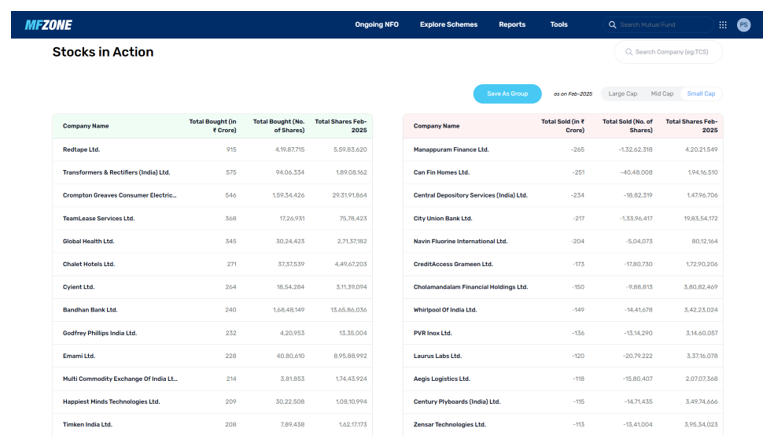

Small-Cap Stocks: Selective Accumulation

Interest in small-cap stocks remained selective, with key purchases including:

- Crompton Greaves – ₹915 crore

- TeamLease Services – ₹368 crore

- Global Health – ₹345 crore

On the other hand, mutual funds pared their holdings in:

- Manappuram Finance – ₹265 crore

- Can Fin Homes – ₹251 crore

- CDSL – ₹234 crore

Source: MFZone By Definedge

Conclusion

Despite market volatility, mutual funds continued their strategic investments across segments, favouring strong large-cap names while selectively increasing exposure to mid and small-cap stocks. However, the decline in SIP inflows suggests some investor caution. As market trends evolve, fund managers are likely to focus on resilience and value-driven opportunities in their portfolios.

Disclaimer: The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. This article is strictly for educative purposes only.

As per SEBI guidelines, the writer and his dependents may or may not hold the stocks/commodities/cryptos/any other assets discussed here. However, clients of Definedge may or may not own these securities.

About Author: Prasiddh Shroff is a Chartered Financial Analyst (CFA) Charter holder with a strong aptitude for mutual fund and company fundamental analysis. At Definedge, he serves as a Research Analyst and has also played a significant role in developing platforms such as MFZone for mutual fund analysis and investments, as well as Radar for company analysis and stock scanning.